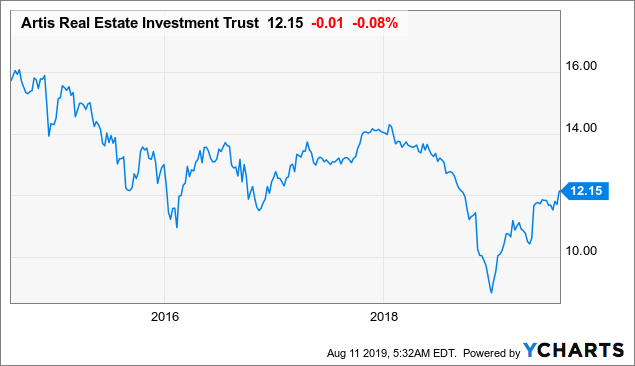

Investment Thesis

Artis REIT (OTCPK:ARESF) (TSX:AX.UN) delivered a solid Q2 2019 as the company continues to execute its strategy to restore investor confidence and improve its balance sheet. The company has a strategy to increase its exposure to industrial properties. This should help it improve its growth outlook as industrial properties are in hot demand due to the rise of e-commerce. The company also has several development projects in progress. Artis is currently trading at a discount to its peers and offers a 4.4%-yielding dividend. However, we expect some short-term volatility in its rental revenues due to the timing of some non-core asset sales. Therefore, we think it is most suitable to investors willing to ride out some short-term volatility.

Data by YCharts

Recent Developments

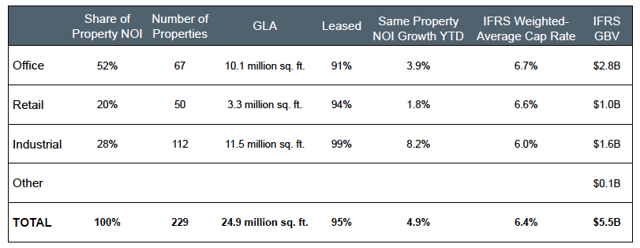

Artis delivered a very good Q2 2019 as the company delivered same property net operating income of 4.9% year over year. This was primarily driven by the 8.2% SPNOI growth of its industrial properties. Its retail properties remain a bit weak with SPNOI growth of only about 1.8% year over year.

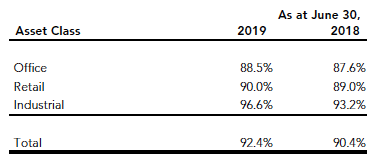

Source: Q2 2019 Investor Presentation

The company also saw its same property occupancy ratio increased to 92.4% in Q2 2019. This was much better than Q2 2018’s 90.4%. This growth was also largely driven by its industrial properties where the occupancy ratio of this asset type increased to 96.6% from 93.2% a year ago.

Source: Q2 2019 MD&A

Earnings and Growth Analysis

Although its strategy to restore investor confidence and improve liquidity may take several years, we believe the company is heading towards the right direction for the following reasons:

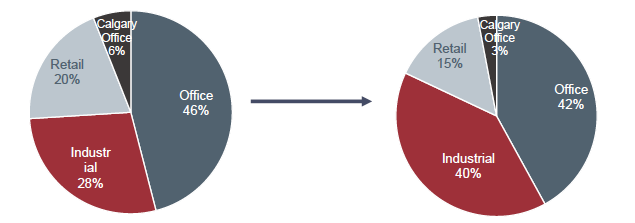

Strategy to increase its exposure to industrial properties is beneficial

Artis has a strategic initiative to improve its portfolio mix through disposition of non-core assets and development projects. The company expects to increase its exposure to industrial properties where this asset type will eventually contribute about 40% of its total net operating income by 2020/2021. This would be much higher than its current exposure of 28% in Q2 2019.

Source: Q2 2019 Investor Presentation

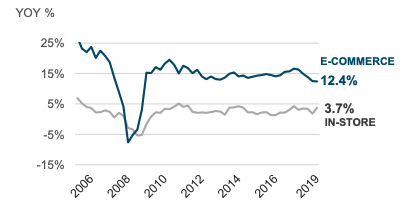

We like Artis’ strategy to increase exposure to industrial properties. As can be seen from the chart below, e-commerce sales in the past 10 years has grown at a compound annual growth rate of about 15% annually. The growth in e-commerce has resulted in strong demand for industrial properties as many businesses set up warehouse locations and distribution centers to meet the shipping demand.

Source: Duke Realty Presentation

This is exactly what PwC’s latest report states,

With increased need for last-mile delivery and e-commerce facilities, logistics and fulfillment continue to be a major opportunity for creating value. As tenants look for increasingly larger spaces, vacancy rates are tightening and rents are rising.

We believe Artis’ Q2 2019 same property NOI growth of 8.2% in its industrial properties is a result of this growth trend.

Looking forward, we think e-commerce sales growth rate will remain robust. This is because consumers increasingly demand quick delivery once they ordered their products online (e.g. within 24 hours). In order to satisfy the demand, the need for more warehouse and distribution centers closer to customers will not diminish any time soon. As an article published by National Real Estate Investor states,

We are likely still in the middle stages of building out the necessary infrastructure to continue to meet growing consumer demand and thus the industrial sector likely continues to expand (albeit at a much slower pace) even in the face of a minor recession.

Therefore, we believe Artis’ plan to increase exposure to industrial properties will help it to continue to grow its top and bottom lines.

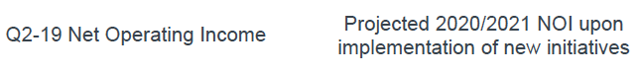

Favorable leasing spreads expected in the next few years

Assuming that Artis can execute its strategy to improve its portfolio and that an economic recession is not imminent, we believe the company will be able to enjoy favorable leasing spreads in the next few years. As can be seen from the table below, the difference in the market rents and in-place rents for its total portfolio is expected to be about 4.6% in 2020. This leasing spread should stay positive through 2023.

Source: Q2 2019 MD&A

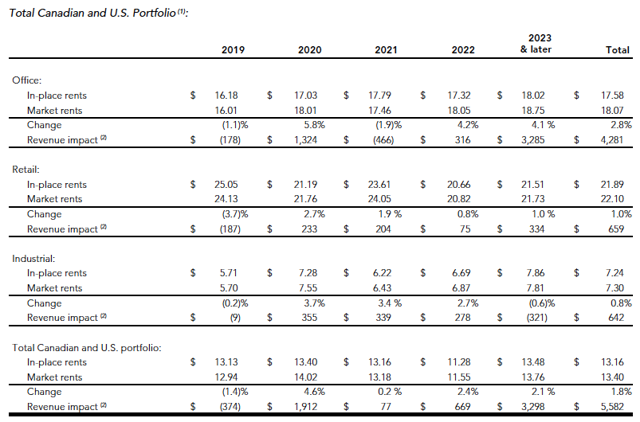

Development projects will improve its top and bottom lines

Artis currently has 4 development projects in progress (see table below). Management has estimated that these development assets will offer 150-200 basis points above acquisition capitalization rates. These projects will add a total of about 1.486 million square feet of gross leasable area and increase its total portfolio by 6%.

Source: Q2 2019 MD&A

An improving balance sheet

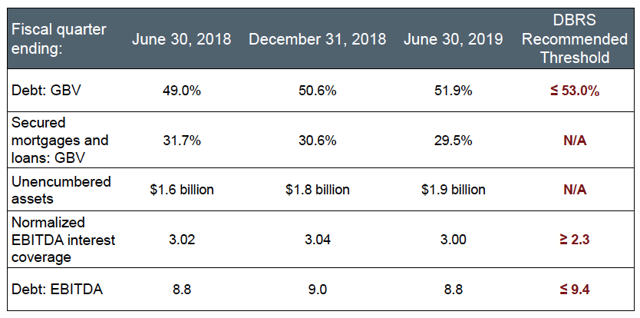

Artis continues to improve its balance sheet. As can be seen from the chart below, its total long-term debt to normalized EBITDA ratio of 8.8x at the end of Q2 2019 is lower than Q1 2019’s 9.0x. We continue to expect Artis to gradually reduce its leverage as it executes the disposition of its non-core assets.

Source: Q2 2019 Investor Presentation

Valuation Analysis

We expect Artis to earn an adjusted funds from operations of about C$1.05 per share. Therefore, its price to 2019 AFFO ratio is about 11.6x. This is significantly lower than its diversified REIT peers. H&R REIT (OTCPK:HRUFF) and Cominar REIT (OTCPK:CMLEF) are trading at price to 2019 AFFO ratios of 13.7x and 13.8x respectively. Artis estimates its current net asset value per share is about C$15.37 per unit. This means that it is currently trading at a price to NAV ratio of only 79%.

A dividend yield of 4.4%

Artis currently pays a monthly dividend of C$0.045 per share. This is equivalent to a dividend yield of about 4.4%. Thanks to a dividend cut of 50% late last year, its dividend is safe with a low payout ratio of about 51.9% in Q2 2019 (based on its AFFO). The possibility of a dividend hike will likely not happen as the company still has a lot of work to do to improve its portfolio quality.

Risks and Challenges

Earnings result may be volatile in the near-term

As Artis executes its disposition plan by selling some of its non-core assets, its rental revenue may be impacted temporarily. Any disposition of its non-core properties may result in a temporary loss in rental revenue until the capital is re-invested towards new properties (either through acquisitions or developments).

Investor Takeaway

We like Artis’ latest result and its strategy to improve its portfolio mix. As long as it can continue to execute its strategy and deliver positive growth consistently, we think its valuation will continue to be re-rated higher. However, investors should keep in mind that Artis' quarterly results may fluctuate depending on the timing of its non-core assets sale.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

2019-08-18 21:59:00Z

https://seekingalpha.com/article/4286493-artis-reit-good-start-turnaround-plan

Bagikan Berita Ini

0 Response to "Artis REIT: A Good Start To Its Turnaround Plan - Seeking Alpha"

Post a Comment