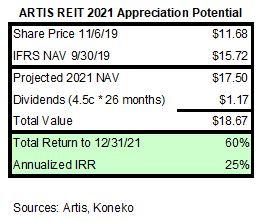

Artis REIT [TSX:AX/UN] (OTCPK:ARESF) has provided a 35% total return since my December article (link). Strong 3Q19 operating results were led by a 19% yoy increase in NOI from US industrial properties. The company has aggressively executed its unit buyback plan and is on a pace to complete $800mm of asset sales.

The company's projection of Year3 Net Asset Value of $17.50 can be easily achieved and likely exceeded through development projects (long-term company target of $3.80/unit in value creation) and retained cash flow (about $1/unit).

A significant risk has been that the company could continue to trade at a large discount to Net Asset Value that might not be eliminated without more aggressive reorganization. The benefits of the plan announced last November are now well understood by the market and the unit price is what it is. The formation of a new Special Committee and activist investor involvement should increase confidence that steps will be taken to deliver fair value to unitholders. Hiring of financial advisors by the Special Committee (link) implies that a significant transaction is being reviewed.

Topics:

- 3Q19 Operating Results

- Relative Multiples

- Strategic Initiative 1: Divestitures

- Strategic Initiative 2: Buyback

- Strategic Initiative 3: Development

- Special Committee & Activist Involvement

- Investment Considerations

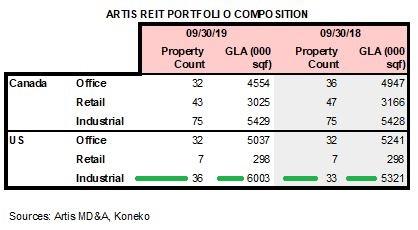

Background: Artis is a diversified Canadian REIT with Office (52%), Industrial (28%), and Retail (20%) assets in Canada (55%) and the United States (45%). Additional information is available at the company website, investor presentation, financial reports, conference call transcripts and prior Koneko articles.

3Q19 Operating Results

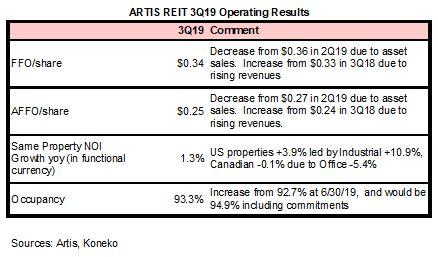

Artis 3Q19 results (press release, MD&A, conference call transcript ) met expectations. Key data:

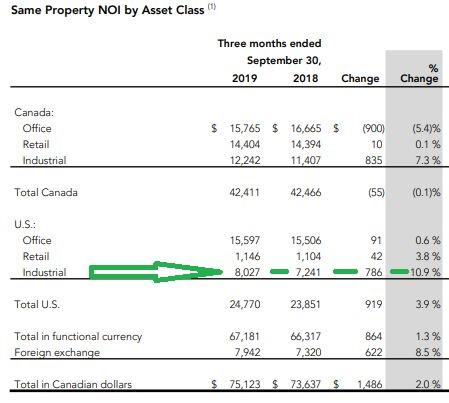

Artis has substantially reduced its exposure to the weak Calgary office market (only 6% of 3Q19 NOI). Results benefited from increased rents from US industrial properties which reported same property NOI +11% yoy. Total NOI from US industrial properties rose from $9.8mm in 3Q18 to $11.7mm in 3Q19 (+19% yoy) due to a 13% increase in GLA.

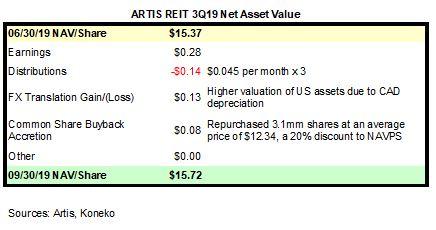

Net Asset Value benefited from appreciation of the USD from CAD$1.315 at 06/30/19 to CAD$1.324 at 09/30/19 and accretion from unit repurchase. Valuation of investment properties was roughly unchanged with a $30mm gain from 415 Yonge in Toronto offset by write-downs elsewhere.

Relative Multiples

Artis trades at a large discount to the valuation of REITs in every sector where it owns assets:

The large valuation gap shows that Artis' valuation is held back by the excessively diversified scope of its business.

Strategic Initiative 1: Divestitures

Artis is aggressively executing its plan to sell $800-1,000mm of property within three years. As of 9/30/19:

- $534mm sold

- $327mm held for sale (includes $60mm under contract)

During the 3Q19 conference call, CEO Armin Martens suggested that further sales at a pace of $200-300mm per year would be recycled into new investments.

Mark Rothschild (Canaccord)

Understood. And in regards to asset sales, you've done quite a bit this year and it seems like there will be quite a bit more closing over the next little while. Do you expect to continue - can this program, will this program be extended to sell more assets that you might see where these are lower growth or markets on be on or is the planned delta stop at a certain number?

Armin Martens

We will say stop and dial it back a notch so to speak, we'll dial it back and we'll continue - you might recall, we used to recycle between $200 million to $300 million of property, but we definitely see more properties that we would like to sell out of and then reposition our portfolio and more aggressively grow the industrial portfolio for example.

That implies that he is not expecting to shrink the company through deployment of further asset sale proceeds into share repurchase or dividends.

Strategic Initiative 2: Buyback

Artis intended to repurchase $270mm of units within three years at an estimated average cost of $11.50. The company aggressively executed the buyback and purchased $170mm of common and $6mm of preferred through 9/30/19. The Normal Course Issuer Bid approved by the TSX in December 2018 was fully utilized, and the company will not be able to buy any more units until the NCIB can be renewed next month.

CFO James Green suggested that management will prioritize debt reduction over share buyback. He also suggested that paying $78mm for redemption of preferred equity counted towards the $270mm share repurchase intention. 3Q19 conference call excerpt:

"In addition to the NCIB purchases as I mentioned, we also redeemed a maturing series of our preferred equity at a cost of $78.4 million. Including the redemption of the preferred equity, we've basically met our target for equity redemption.

We have reached the maximum trust unit purchases permitted under the current NCIB and we will be renewing in December although in future unit purchases under that plan will be dependent on the trading value of our units at that time and the amount of debt reduction we have achieved. In our opinion, it's more important to get our balance sheet metrics under control first."

CEO Martens similarly asserted that the buyback commitment is nearly complete:

I think our buyback program is basically 70% complete and when one considers the $85 million of preferred equity, we also bought back, we've invested $260 million in equity buyback in the past 12 months.

These comments seem considerably less shareholder friendly than prior management statements about the undervaluation of Artis units and that "a [Substantial Issuer Bid] is not off the table" (1Q19 conference call).

The company's deleveraging plan will use up most of the proceeds from remaining asset sales. Management said:

"We anticipate bringing debt to GBV back under 50% in the near future as further asset sales are completed and we are targeting a range of 45% to 48% over time".

Strategic Initiative 3: Development

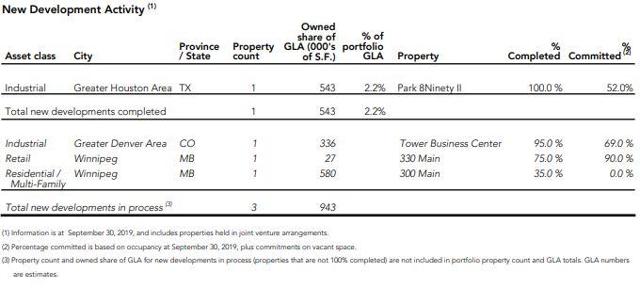

Artis plans to invest about $200mm over the next three years in multi-phase new industrial developments in the US. The company completed a large Houston project in 3Q19 (Park 8Ninety II) which was 52% committed as of 9/30/19. New developments contributed to the 19% yoy increase in US industrial NOI. Additional projects under construction:

Artis will earn additional profits by preparing certain existing properties for residential conversion and then selling to third parties after zoning approvals have been received. 3Q19 MD&A excerpt:

Rezoning and Densification Initiatives

Artis is exploring opportunities for a densification project at Concorde Corporate Centre in the Greater Toronto Area, Ontario. The site provides direct access to Don Valley Parkway and convenient access to other major thoroughfares in the Greater Toronto Area. Preliminary plans are underway to build approximately 600 apartment units on the site.

Artis is exploring opportunities for a densification project at Poco Place in Port Coquitlam, British Columbia. The site provides access to major transportation routes and frontage on four streets, including Lougheed Highway, an east-west arterial corridor. Preliminary plans to build 600 to 900 apartment units are underway.

Stampede Station II development land on Macleod Trail in Calgary, Alberta, has been rezoned from office to multi-residential. The original plan for a 300,000 square foot office project has been changed to a 30-storey multi-family project with 300 suites. This land is classified as held for sale at September 30, 2019.

The IFRS carrying values of these redevelopment properties are based on current usage and rents so sales after successful rezoning with increased density should provide significant gains.

Special Committee & Activist Involvement

Artis has a clear path to increasing asset value over time through development; however, its diversified business model is unpopular with investors. There has been a risk that the strategic initiatives announced last fall would be insufficient to improve the company's appeal. Indeed management appears to believe that it has delivered its commitments and the units continue to trade at a large discount to fair value.

Prior Koneko articles suggested that Artis could be pushed towards further strategic actions by an activist investor (Sandpiper Group) who has a successfully pushed for changes other companies including Agellan Commercial REIT and Granite REIT (see 03/19/19 article for background on Sandpiper's record) .

In May, Artis announced the formation of a "Special Committee of Independent Trustees to review and evaluate additional strategic alternatives that may arise". 3Q19 reporting included only a vague management response to an analyst question about the committee:

I would expect between now and next June AGM, we will get a lot of visibility from them and get the report from them. And things will either ramp up or wind down.

Artis' management seems comfortable that the company's problems have been solved: Calgary office exposure will be just 3% of NOI by 1Q20, distribution coverage is excellent, FFO/AFFO are growing, and the company has a pipeline of US industrial developments. But it is unlikely that investors will be able to realize the fair value of the company's assets and cash flows without further strategic initiatives.

Dream Office provides an example of a REIT that successfully transitioned from an over-diversified portfolio valued by the market at a discount to a focused portfolio that now trades at a premium. Dream initially projected sale of $1.2Bn of assets (February 2016 announcement), but ultimately sold $3.4Bn and used the proceeds to reduce units outstanding by 43%.

The Artis Special Committee could urge the company to sell all of its remaining non-industrial assets. Alternatively, the industrial sites could be sold in the current strong market and proceeds delivered to shareholders through dividends and unit buyback. I believe it's unlikely that an acquirer would be interested in the entire company in its current diversified form.

Investment Considerations

Investors punished Artis for reducing its dividend rate, but dividends simply transfer value rather than creating value. Any change in the dividend does not affect the underlying value of the company and its assets, so this article does not offer any detailed commentary about past present or future dividends. The distribution (currently C$0.54/year) gradually returns a portion of the full NAV, which we can now acquire in the market at a discount.

Artis' unitholders will be rewarded if corporate actions succeed in narrowing the NAV discount, so investors should be attuned to board membership, the unitholder roster, and developments at peer companies that may hint at the path that Artis will follow. Management's apparent diminished interest in strategic initiatives means there is some risk that no further actions are taken and the unit price languishes around the current level.

Disclosure: I am/we are long ARESF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author is a unitholder of Artis REIT. The author does not make any recommendation regarding any investment in any company mentioned in this article. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions.

"Art Is Not Enough" was a 1980s' activist campaign to raise AIDS awareness.

2019-11-09 09:30:00Z

https://seekingalpha.com/article/4304784-artis-reit-good-results-appreciation-depends-new-strategic-initiatives

Bagikan Berita Ini

0 Response to "Artis REIT: Good Results, But Appreciation Depends On New Strategic Initiatives - Seeking Alpha"

Post a Comment