Armin Martens has been the CEO of Artis Real Estate Investment Trust (TSE:AX.UN) since 2004, and this article will examine the executive’s compensation with respect to the overall performance of the company. This analysis will also assess whether Artis Real Estate Investment Trust pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Artis Real Estate Investment Trust

Comparing Artis Real Estate Investment Trust’s CEO Compensation With the industry

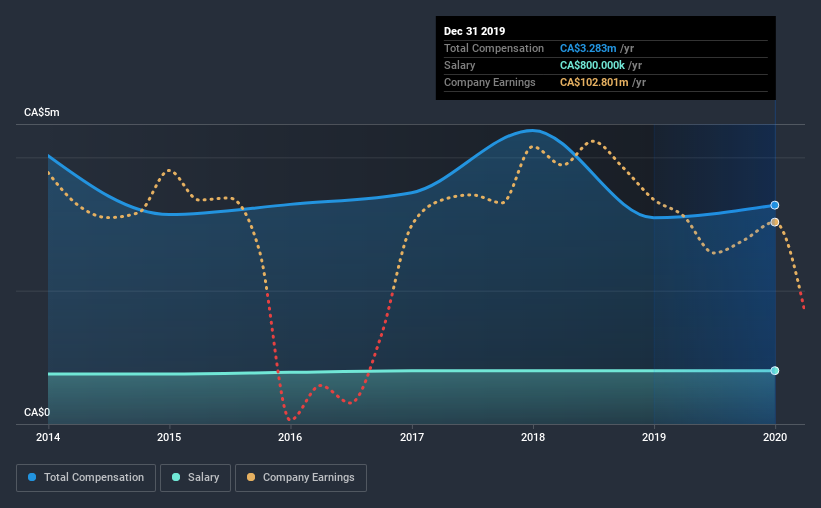

At the time of writing, our data shows that Artis Real Estate Investment Trust has a market capitalization of CA$1.1b, and reported total annual CEO compensation of CA$3.3m for the year to December 2019. That’s a modest increase of 6.1% on the prior year. While we always look at total compensation first, our analysis shows that the salary component is less, at CA$800k.

In comparison with other companies in the industry with market capitalizations ranging from CA$537m to CA$2.1b, the reported median CEO total compensation was CA$1.6m. Accordingly, our analysis reveals that Artis Real Estate Investment Trust pays Armin Martens north of the industry median. Furthermore, Armin Martens directly owns CA$6.3m worth of shares in the company, implying that they are deeply invested in the company’s success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CA$800k | CA$800k | 24% |

| Other | CA$2.5m | CA$2.3m | 76% |

| Total Compensation | CA$3.3m | CA$3.1m | 100% |

On an industry level, around 33% of total compensation represents salary and 67% is other remuneration. It’s interesting to note that Artis Real Estate Investment Trust allocates a smaller portion of compensation to salary in comparison to the broader industry. It’s important to note that a slant towards non-salary compensation suggests that total pay is tied to the company’s performance.

Artis Real Estate Investment Trust’s Growth

Artis Real Estate Investment Trust has reduced its earnings per share by 35% a year over the last three years. Its revenue is down 2.7% over the previous year.

Few shareholders would be pleased to read that earnings have declined. And the impression is worse when you consider revenue is down year-on-year. It’s hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Artis Real Estate Investment Trust Been A Good Investment?

Given the total shareholder loss of 28% over three years, many shareholders in Artis Real Estate Investment Trust are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude…

As we noted earlier, Artis Real Estate Investment Trust pays its CEO higher than the norm for similar-sized companies belonging to the same industry. Disappointingly, share price gains over the last three years have failed to materialize. Add to that declining earnings growth, and you have the perfect recipe for shareholder irritation. Overall, with such poor performance, shareholder’s would probably have questions if the company decided to give the CEO a raise.

CEO compensation can have a massive impact on performance, but it’s just one element. We did our research and spotted 1 warning sign for Artis Real Estate Investment Trust that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Promoted

If you’re looking to trade Artis Real Estate Investment Trust, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Discounted cash flow calculation for every stock

Simply Wall St does a detailed discounted cash flow calculation every 6 hours for every stock on the market, so if you want to find the intrinsic value of any company just search here. It’s FREE.2020-07-27 19:32:08Z

https://simplywall.st/stocks/ca/real-estate/tsx-ax.un/artis-real-estate-investment-trust-shares/news/what-can-we-learn-about-artis-real-estate-investment-trusts-tseax-un-ceo-compensation/

Bagikan Berita Ini

0 Response to "What Can We Learn About Artis Real Estate Investment Trust’s (TSE:AX.UN) CEO Compensation? - Simply Wall St"

Post a Comment