In the Crosshairs of Activists

Artis REIT (OTCPK:ARESF) has found itself in the crosshairs of a Canadian activist investor, the private equity firm Sandpiper Group, which launched its bid to oust the CEO and four other longstanding members of the board of trustees by publishing a presentation on Oct. 7th.

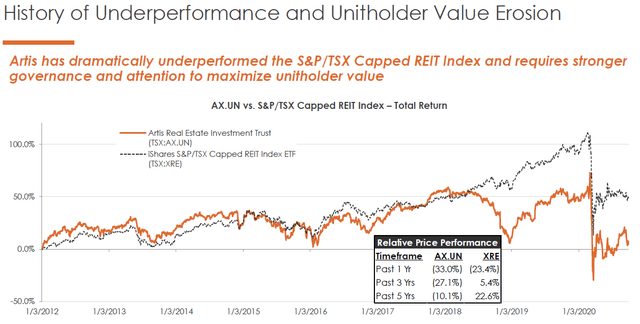

Artis, a diversified REIT with exposure to industrial, office and retail sectors, has been an underperformer for a long time and is trading at a steep discount to its peers. Sandpiper believes it can unlock value for shareholders by replacing the entrenched board and ineffective management.

Source: Sandpiper Group presentation

Source: Sandpiper Group presentation

What is wrong at Artis?

Sandpiper's critique of the management and board touches upon three key areas:

- Failed stewardship

- Extensive familial transactions

- Poor asset management and decision-making

Given the contentious nature of claims and counter claims, I will jump straight to my thesis, leaving the reader to browse the Sandpiper presentation for further details.

The last straw

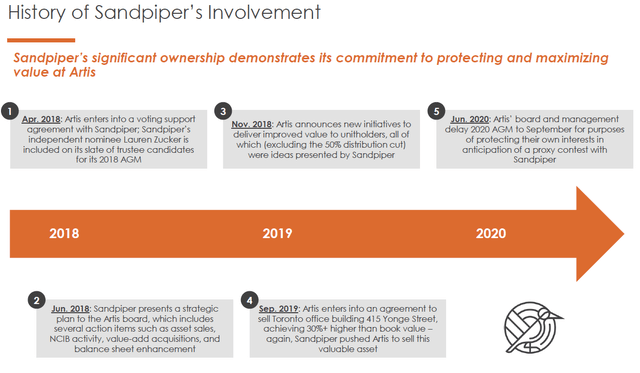

Sandpiper is no stranger to Artis. It has been working with the management since early 2018 to bring about moderate change through its representation in the board by Ms. Lauren Zucker and by dialogue with the management as a significant investor. Although Sandpiper has noted in the presentation that some of the ideas championed by it have been adopted by the management, I suspect that it has been an uneasy relationship for both parties.

Source: Sandpiper Group presentation

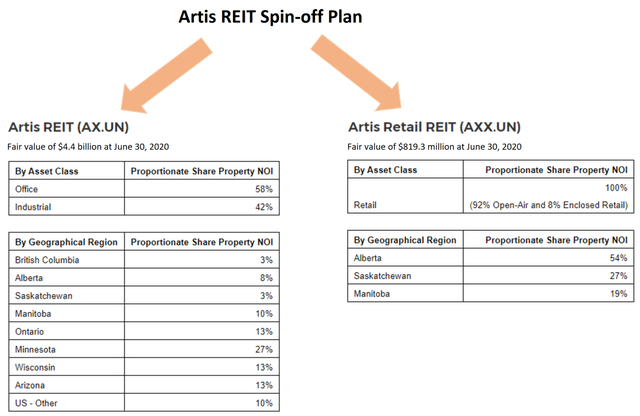

Sandpiper has finally lost patience with the management after they decided to go ahead with their plans of spinning off Artis retail property portfolio as a small-cap pure play retail REIT, a strategy opposed by Sandpiper. The Artis Retail REIT spin-off is to be tabled for approval by unitholders in mid-November.

Source: Corporate press release

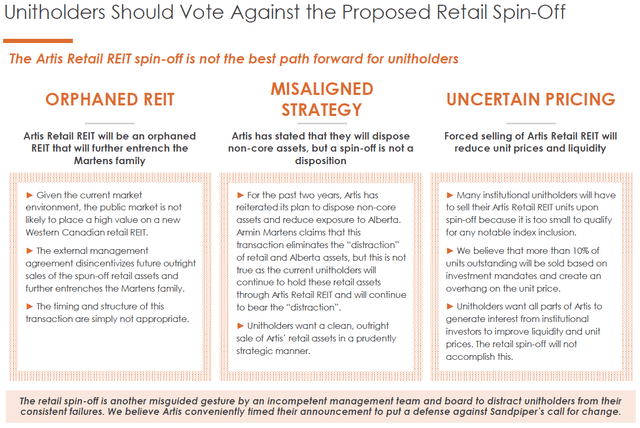

Sandpiper is urging unitholders to reject the proposed spin-off as it prefers an outright sale of retail assets at the right price/at the right time instead of a spin-off.

Source: Sandpiper Group presentation

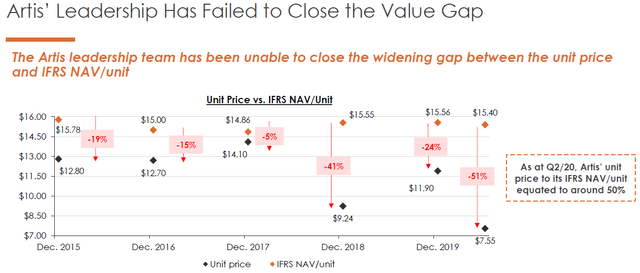

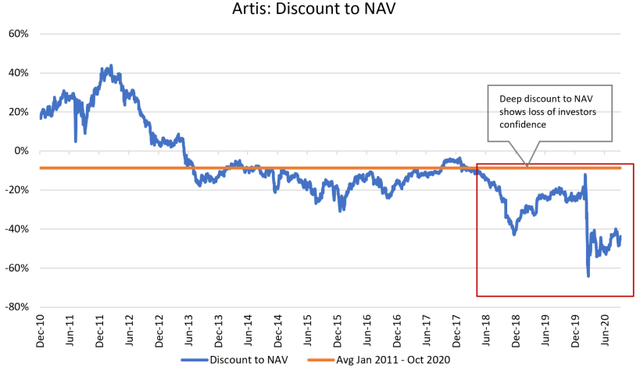

Dirt cheap valuation reflects lack of investor confidence

A recurring theme in Sandpiper's presentation is that all the ills afflicting Artis have ultimately resulted in stock price trading at a steep discount to Net Asset Value (or "NAV") as investors don't have confidence in the management and its strategy.

Source: Sandpiper Group presentation

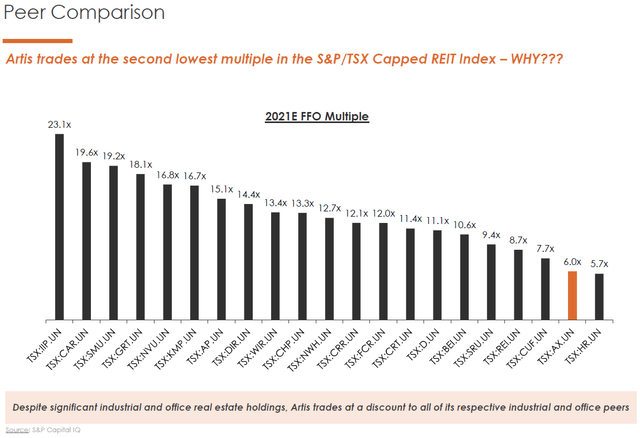

A comparison to peers' valuation also drives home the same message that all is not well at Artis.

Source: Sandpiper Group presentation

How will Sandpiper unlock value?

For Sandpiper's gripes to be taken seriously, we should expect them to come up with a better way of running Artis. To this end, Sandpiper's turnaround playbook involves the following:

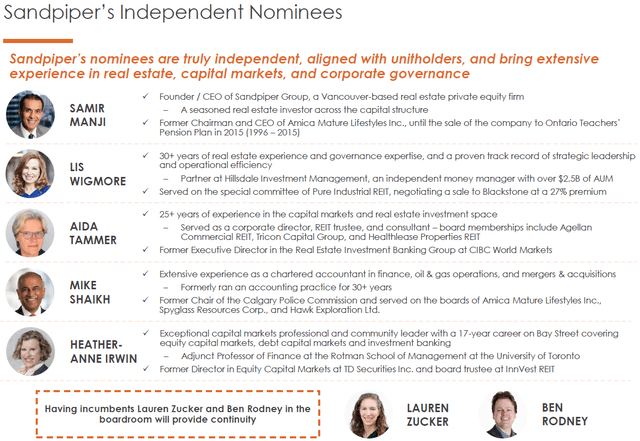

A new board and a new top management team

The first thing on the slate of Sandpiper is replacing the CEO and four board members with its own nominees. Essentially, Sandpiper is saying that five longstanding board members, including the Chairman and the CEO, are part of the problem and cannot be a part of the solution. Sandpiper pointedly notes that the incentive structure of non-executive trustees is not aligned with the shareholders as they have negligible ownership of Artis units and have a preference for cash compensation. Sandpiper intends to bring a top tier board comprising of real estate, capital markets and governance experts. It is also proposing to replace the incumbent Chairman with Mr. Samir Manji, Founder & CEO of Sandpiper Group. More importantly, the plan is to revamp the board compensation structure to make it more aligned with shareholders by paying a larger portion in the form of share-based awards.

Source: Sandpiper Group presentation

Cost cutting to translate into 10% higher distributions

Sandpiper presents a reduction in corporate costs (general and administrative costs, board compensation, services obtained from related parties, etc.) as the low hanging fruit that can result in "an immediate increase to the distribution by at least 10% to put more money into the pockets of all unitholders".

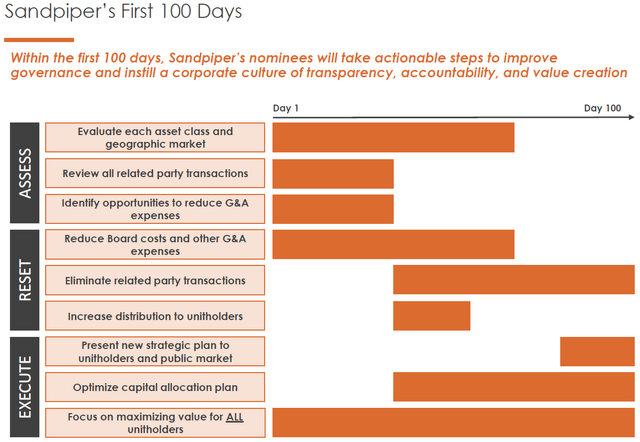

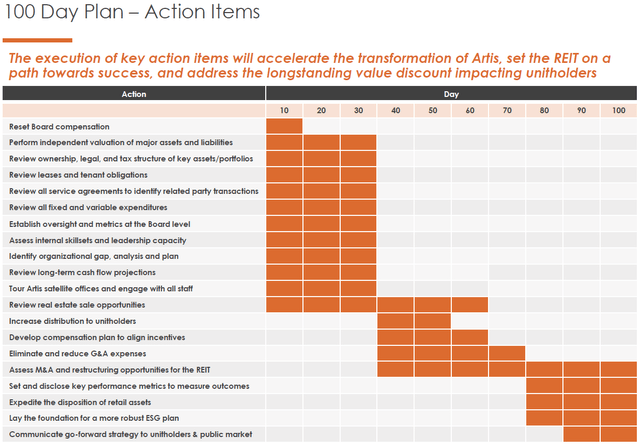

100-day plan and new strategy

Sandpiper has a 100-day plan which it will implement to craft a new strategy. The two slides which provide a glimpse of what is to come are presented below. On the face of it, all of it seems common sense and makes one wonder why the incumbent management did not think of it. However, having seen quite a few entrenched management/cozy board tag teams in the past, I would give Sandpiper the credit for doing a good job of vigorously shaking things up.

Source: Sandpiper Group presentation

The devil in the detail

As the old saying goes, the devil is in the detail. At this early stage, Sandpiper is keeping its cards close to its chest. Unlike its past transactions like Granite REIT, it has not given out what major changes in strategy it intends to implement which will result in meeting the ultimate objective of removing the 50%+ discount to NAV.

Sandpiper has listed out typical private equity recipe steps like cutting costs, seeking asset sale opportunities, increasing distributions and optimizing capital allocation. These changes, if executed successfully, are likely to increase the cash flows and the intrinsic value of the company. However, a steep valuation discount which comes from investors' poor perception of Artis' track record will not go away without a solid demonstration of the new strategy in action.

Having said this, there is one proven way of taking stock price higher which is absent from Sandpiper's presentation, i.e. stock buybacks. Corporate Finance 101 teaches us to buy stocks when they are undervalued relative to the true value (NAV of CAD16.00+ in the case of Artis) and to sell shares when they are trading above the intrinsic value. Companies do this by buying back shares when they are trading low and issuing new equity when the stock price is high.

The incumbent management were not big fans of stock buybacks and they initiated their first NCIB not too far ago in November 2018 when the discount to NAV hit 30%+ (i.e. the stock price started trading at a Price to NAV of less than 0.70x). The NCIB was renewed in December 2019 for another 10% of the public float, but the management only bought approx. CAD 6 million worth of units during 1Q 2020 and another approx. CAD 13 million during 2Q 2020, taking advantage of a stock price trading around 0.50x Price to NAV.

In my view, this omission of buybacks from the presentation seems intentional so that income seeking dividend investors don't get unnerved. Sandpiper will make a token 10% increase in dividend distributions to tick a box in its 5-Step Action Plan to generate goodwill among retail income investors. However, this will be followed by a ramp-up of buyback activity in its new strategic plan to optimize capital allocation towards buying undervalued equity. To me this makes more sense than building more properties which might remain unappreciated by skeptical shareholders.

Things that can go wrong

The biggest risk here is whether Sandpiper can successfully execute its best laid plans. Sandpiper established in 2016 has been in the headlines for the past several years for its activist investing in Canadian REITs. Its track record includes notable successes at Granite REIT and Agellan Comercial REIT. In my view, Sandpiper's stated goals in these past transactions were more controllable like bringing efficient balance sheet utilization or preventing a large payout to an external manager compared to bridging the valuation gap for Artis.

Looking at Sandpiper's turnaround of Granite REIT over the past three years, one thing is very clear that it has the ability to put together a team of professionals with tons of experience under their belt. Ultimately, the success of Sandpiper's strategic pivot for Artis will depend on the quality of new team and the degree of involvement of the new Chairman who has been quite open about his ambitious plans to overhaul multiple Canadian REITs.

Final Words

My take on the Artis-Sandpiper saga is that shareholders have nothing to lose by shaking up the way this company is being run and bringing in a new team. Sandpiper has proven itself as a change agent in previous transactions and could be successful in turning around Artis with time on its side.

I am not a big fan of diversified REITs like Artis (Industrial, Office and Retail all rolled into one) as one needs pure play single-sector focused REITs to make clear investment decisions. Office and Retail properties are currently under the COVID-19 cloud with diminishing demand prospects. However, the deep discount to NAV of nearly 50% offered by Artis is enticing. I like the way Sandpiper is zooming in on bridging this discount as the centerpiece of its turnaround strategy. At the same time, I am conscious that like all turnaround plays, this one is going to take some time to bear fruits. If I was an Artis shareholder, I would be throwing my lot with the activists.

If you have read this far and would like to get a notification when I publish a new article, please "Follow" me.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is a personal opinion only and should not be considered as an "investment advice" or as a "recommendation" regarding a course of action. Only registered investment advisers can provide personalized investment advice. Investors should get personal advice from their investment adviser and should make independent investigations before acting on any information published here.

2020-10-12 12:41:00Z

https://seekingalpha.com/article/4378596-artis-reit-can-activists-unlock-value

Bagikan Berita Ini

0 Response to "Artis REIT: Can Activists Unlock Value? - Seeking Alpha"

Post a Comment