Kevin Frayer

Thesis

If we compare Kering (OTCPK:PPRUF) with the other luxury brands, they have a better valuation at the moment, but is that enough to justify an investment? I think their overall heavy reliance on Gucci, which is struggling a bit right now, and the controversy with Balenciaga are some things that could argue against an investment. But good companies that are out of favor because of some temporary difficulties are some of the best long-term investments.

Analysis

FY22 Kering

2022 was a mix of good and bad for Kering. Full-year sales were up 15% year-on-year, but only 9% at constant exchange rates, which is still quite good in such a stormy economic year. But their biggest brand Gucci only grew 1% on a comparable basis, which they addressed in their Q4 earnings call, saying that they have higher expectations and that they believe they have more potential as a company.

As Gucci is their most important asset, accounting for ~50% of revenues and having the best margins of all their holdings, they have made investments for the long term, so hopefully Gucci will show better results in the coming years.

- Gucci: 35.6% operating margin

- YSL: 30%+ operating margin

- Bottega Veneta: 21% operating margin

- Other Houses: 14.4% operating margin

- Kering Eyewear: negative operating margin

All this translates into an operating margin of 27.5% for the whole company, which is a really good number compared to other industries, and even in the luxury industry they are better than most companies on a margin basis. However, in contrast to last year, margins fell by 90 points as a result of the investments made.

Major changes in the past year have been the news of a new creative director for Gucci and the big controversy with Balenciaga at the end of last year. Sabato De Sarno's first collection will debut in September 2023 and the success or failure of his appointment will probably be visible in 2024 or 2025.

The Balenciaga scandal, on the other hand, is still affecting them and they said on the earnings call that they think it will be over in Q2. But I am not quite sure if such a storm is over in such a short period of time or if there will be a longer lasting damage to the Balenciaga brand.

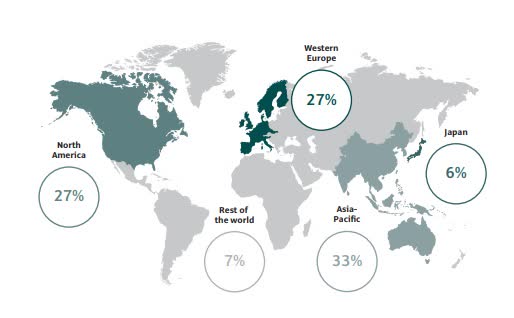

FY22 Kering Presentation

Asia's numbers are down 8%, but are expected to rise in 2023 as the country reopens, boosting overall revenue. The young and affluent Chinese are a huge consumer base for all luxury brands and their products. It will be interesting to see which styles and brands they prefer. In the summer of 2022, Balenciaga still had a hype in summer destinations like Ibiza. But in my opinion, brands like Palm Angels, Off-White or Prada were what you saw most.

But this is a market where the trendy brand can change very quickly. There were times when Kenzo, Givenchy, Valentino or Balmain were the brands of choice for a while. So it will be interesting to see which brand will have the hype in 2023 and whether the trends are the same in China, the US and the EU.

FY22 Kering Presentation

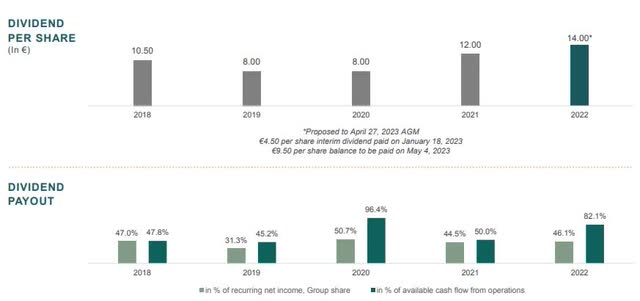

In 2022, Kering returned €2.6 billion to shareholders through buybacks and dividends. 1.5 billion was in the form of dividends. But as you can see from the chart, dividends are unreliable as they sometimes fluctuate or stagnate. So if you are dependent on dividends as a source of income, this is not the stock for you at the moment. But this could change as they have introduced their first employee share scheme, which I think is a positive sign.

Author

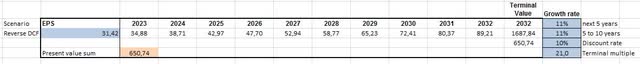

If we take the basic EPS of $31.42 and today's multiple of 21, we see that 11% EPS growth over the next 10 years is priced into the share price. This is not an easy task, but I think they could do it because they are a high-quality business.

Metrics

- EV/EBIT: ~14

- ROC: 15%+

- ROE: 20%+

For example, with an EV/EBIT of around 14, Kering is cheaper than LVMH (OTCPK:LVMHF), but this is partly because LVMH is a much better diversified company. Kering is too dependent on Gucci. But still, with a multiple of 14, they have a good valuation in terms of future projects.

Their return on capital and return on equity figures also show that they can allocate capital efficiently. Borrowings maturing in one year amount to $2,295 million, which is less than cash and cash equivalents of $4,336 million. This, together with a debt to equity ratio of 15.6%, shows that they have a strong balance sheet.

Growth Opportunities

Kering takes a long-term view of its business and allocates capital where it believes it will generate the best returns in the future. Kering Eyewear and the new beauty strategy are the current growth projects. They have stated that they want to build desire and legacy with their brands. And desire is important in the luxury segment.

Brands like Gucci also have a very strong competitive advantage because of their long-standing brand and what people associate with it.

Conclusion

Many people believed that rising interest rates would have a big impact on the sales of luxury companies, thinking that this was an area where people would save money. But the rich, or people who want to look rich, are still spending a lot on luxury, as you can see from Kering and LVMH's 2022 sales figures.

Kering invested more than usual in 2022, and their CapEx grew by 15% year-on-year, in line with revenue, which also grew by 15%. This is something to watch in 2023.

Looking at EV/EBIT alone, this could be a buy at the moment. However, as Gucci accounts for 50% of revenues and has struggled over the past year, I would wait and see how this develops with the new creative designer and the reopening of China. And how the situation at Balenciaga will develop over the next few months. I am not sure it will be over as quickly as Kering thinks.

But if you think Kering will get through all these problems, this could be the right entry price for you.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

from "luxurious" - Google News https://ift.tt/HRKwh2Q

via IFTTT

Bagikan Berita Ini

0 Response to "Kering SA: A Luxurious Company At A Not-So-Luxurious Price ... - Seeking Alpha"

Post a Comment