| Sandpiper - Pixar Short |

Artis REIT (OTCPK:ARESF) (TSX:AX/UN) 3Q20 results demonstrated stability in each of its business segments that should increase investor confidence in the company's IFRS asset value ($15.35/unit). The key challenge for the company is to implement corporate actions to deliver that value to investors. The Special Committee of Independent Trustees concluded its Strategic Review in May without announcing a transaction, however, "some ongoing dialogue continues". Unitholder pressure is likely to result in a sale or break-up.

Topics:

- History of Strategic Initiatives

- Sandpiper Proxy Campaign and Artis Response

- Preferred Holder Firm Capital Opposes Retail Spinoff

- 3Q20 Operating Results

- Break-Up

- Investment Considerations

(all amounts in the article in Canadian dollars)

History Of Strategic Initiatives

Artis management and board have been under pressure for several years due to:

- High legacy exposure to the province of Alberta (39% of 2014 NOI) where falling oil prices weakened the economy and led to severe office vacancy rates and falling rents.

- Diversified business model (Office + Retail + Industrial in the US + Canada) that is out of favor with investors. Other diversified Canadian REITs are also trading at large discounts to IFRS NAV as of 11/06/20 (Brookfield 48%, Morguard 78%, Cominar 50%)

- Activist unitholder (Sandpiper Group) since 2018, low insider ownership (1%), and absence of any large supportive unitholders

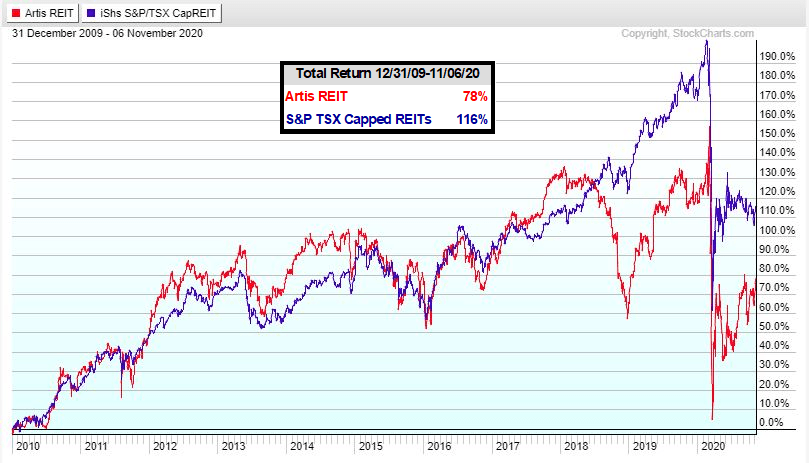

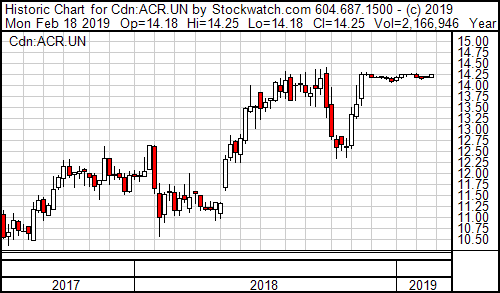

- Below average long-term total return. Artis units traded in line with the sector until 2018 when a distribution cut served as a catalyst for the unit price to drop in reflection of several years of deteriorating performance (falling asset value and FFO due to Alberta exposure). The all-time high unit price was reached in 2007.

Artis has launched a series of initiatives in response to the pressure:

- 2018 Strategic Plan - In November 2018, Artis announced a plan to sell $800mm of assets (especially Calgary Office), repurchase $250mm of units, reduce leverage, and invest in industrial developments.

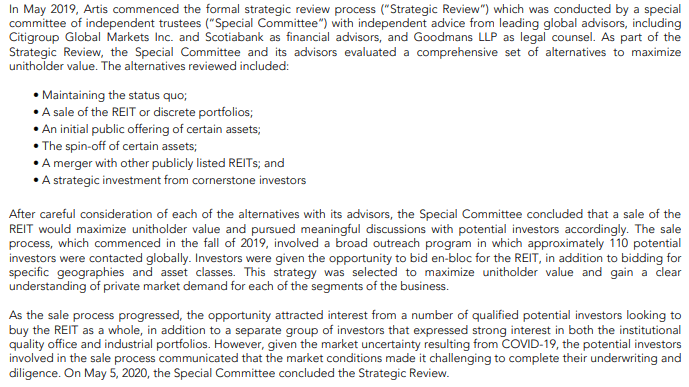

- 2019 Review of Strategic Alternatives - In May 2019, Artis announced the formation of a Special Committee of Independent Trustees to "review and evaluate additional strategic alternatives that may arise". The Committee concluded its work in May 2020. Artis 3Q20 MD&A explained:

- 2020 Strategic Plan including Retail Spinoff - In September 2020, Artis announced that it would sell an additional $550mm of assets and spin off its retail assets to a new public REIT. During the conference call, describing the plan, CEO Armin Martens acknowledged that the diversified business model was responsible for the low unit valuation:

There's an old saying the customer is always right. And if the investors want pure-play REITs then that's the direction we have to go in order to increase unitholder value".

Artis 3Q20 conference call disclosed some new information about the strategic review undertaken over the past year.

I still think the retail spin-off a great idea. It moves us forward to just being an office-industrial REIT which we can then spin off again or we privatize. Either way, it gets us to a better price multiple as an industrial without the retail. in the retail we get - whatever price we get, it's more than worth what we're getting now."

A year ago before this pandemic came upon us, we shifted the paradigm. And while we were doing it, we thought we can sell all down all retail in a three-year period. We don't think that anymore because we don't want to give it away, right? But we can continue to sell some retail and improve our balance sheet and improve our portfolio, streamline our portfolio. And then we'll sell some more office as well and we'll grow industrial."

some ongoing dialogue [with potential acquirers contacted during the Strategic Review] - is taking place and interest continues. But there's nothing much more we can say on that front."

Artis mentioned that the Retail Spinoff had been unanimously approved by the Board which implies consent from the two Trustees that Sandpiper wants to retain.

Sandpiper Proxy Campaign And Artis Response

On 10/1/20, Sandpiper Group issued a press release announcing that it had requisitioned a Special Meeting of unitholders to replace 5 of the 7 current Trustees. In addition to Sandpiper CEO Samir Manji, the other 4 nominees appear highly qualified. Sandpiper stated that it wanted the Retail assets sold at fair value to a strategic acquirer rather than distributed in a spinoff that would be undervalued in the market.

Sandpiper released a presentation highlighting what it claimed were conflicts on interest between Artis and businesses controlled by family members of CEO Armin Martens.

Key Points:

- Related Party Transactions - Artis stated in 2017 that the Martens controlled Marwest companies would no longer be considered related parties requiring disclosure of transactions with Artis. Sandpiper identified numerous subsequent transactions where Artis contracted with Marwest entities for services including property management, project management, leasing, and development.

- Poor Capital Allocation - Artis incurred cumulative fair value losses of $754mm, primarily from Calgary Office assets.

- Entrenched Board with No Alignment - Four of the Trustees have served the REIT since its inception 16 years ago. In October, Artis suddenly announced discovery of "new information" resulting in a determination that one of these long-term Trustees was not actually independent and he immediately resigned.

Sandpiper subsequently announced that its nominees had the support of Artis' largest unitholder with a 13.1% stake, then announced pledges of support from 35% of the outstanding units (enough to reject approval of the proposed Retail spinoff).

Artis responded with a press release to "Set The Record Straight" which made these points that confirmed many of Sandpiper's allegations, but tried to diminish their importance:

- "Robust" NAV growth of 2% per year since 2011

- Successful sale of Western Canada assets (that were previously purchased at higher prices)

- Only $35mm has been paid to Marwest companies for services at competitive rates

- Artis has been executing value-enhancing strategic initiatives including asset sales and share repurchase

Artis published a presentation on 11/5 with useful new information:

- Artis has invested $214mm in Industrial development projects since 2014 and achieved an IRR of 29.8%

- During the Strategic Review, the "Special Committee concluded that a sale of the REIT would maximize unitholder value"

Preferred Holder Firm Capital Opposes Retail Spinoff

The Retail spin would require approval from 2/3 of both common and preferred unitholders, each voting as a class. On 10/1/20, preferred holder Firm Capital Private Equity (FC) issued a press release explaining its opposition to the spinoff because it would reduce the equity cushion below the preferred units making them more risky. FC argued that the structure of the Retail spinoff should entitle preferred holders to redemption at par value ($25 for each of the outstanding Series A, E, and I units). On 11/2/20, FC issued a press release signalling its support for Sandpiper and published a website with copies of its correspondence with Artis and its advisors.

3Q20 Operating Results

Artis 3Q20 results (press release, MD&A, conference call transcript, presentation) demonstrated that property-level performance is stabilizing after the COVID impact. Highlights:

- FFO $0.37/unit vs $0.36 in 2Q20 and $0.34 in 3Q19. The company also provided guidance for 2021 FFO of $1.35

- AFFO $0.27/unit vs $0.25 in 2Q20 and $0.25 in 3Q19. The company also provided guidance for 2021 AFFO of $1.00

- NAV declined slightly in 3Q20 to $15.35/unit due to the impact of translating the value of US$ assets into appreciating C$.

- Occupancy declined slightly to 90% compared to 90.6% in 2Q20.

- Rent collection of 97.6% of amounts due in 3Q20. As of 10/31 97.4% of October, rents had been collected.

The MD&A includes some enhanced disclosures that could be helpful to analysts and investors in valuing each of Artis segments, however, the primary driver of the unit price will be the high level discount resulting from the diversified business model. The disclosures provide more confidence that performance is stable enough for value to be realized through strategic actions that reduce or eliminate the discount.

Break-Up

Artis spent $4.6mm in 2019-20 on what appears to have been a robust strategic review. If management and trustees want to avoid being replaced by Sandpiper nominees who might repeat much of the same work, then they should share the conclusions of that review and how the company will use them to deliver value to unitholders in coming years. CEO Armin Martens is not the best spokesperson for this communication due to:

- Marwest conflicts - his family business relationships with Artis could create conflicts between his personal financial interest and that of public unitholders

- Transaction conflicts - he was rumored to be connected to a bid for some or all of the company's assets

- Lack of Conviction - Martens has been ambivalent about the strategic initiatives he is responsible for implementing. In this BNN interview, he admits that he prefers the company's existing diversified business model even as he explains that the company will spin off its Retail business in the near-term and follow with a spin of the Industrial business if the market valuation has not improved.

If management and Board want to avoid being replaced, then it would be helpful if they could comment on these topics:

- The Strategic Review ended in May when there were few real estate transactions of any kind due to COVID lockdown. Can negotiations with interested parties resume now that Artis' business is close to normal?

- Were there issues that made it difficult to execute a transaction? Tax? Lack of a natural buyer for the entire diversified business? Is Artis doing anything to address those issues and make the company more attractive to strategic buyers?

- When Artis announced its Retail spinoff, it also disclosed that it would reorganize its legal structure to facilitate a possible future spinoff or sale of its Industrial properties. Management hinted that an Industrial spin could come in about a year, but made no clear statement and then didn't mention it in the 3Q20 conference call. Is there a plan?

The actions that Artis has taken over the past 18 months have been positive, but CEO Armin Martens has always come across as a reluctant convert responding to pressure from Sandpiper (page 15 from Sandpiper presentation). If Sandpiper were represented directly on the Board, then unitholders could be more confident that inertia, lack of expertise, and conflicts of interest would not impede value realization.

I believe the most likely outcome is a negotiated settlement prior to the Special Meeting with most of Sandpiper's nominees added to the Board and most of Sandpiper's agenda implemented. This would follow precedents:

- Agellan Commercial (10% Sandpiper stake disclosed 9/19/17)- Sandpiper protested a $15mm payout to the REIT's external manager, received support from 35% of outstanding shares in calling a special shareholder meeting to replace certain directors, and reached a settlement agreement which included appointment of three new directors. The REIT was subsequently acquired at a 15% premium to its IFRS Net Asset Value and at a substantial increase over the price at which Sandpiper became involved. Like Artis, Agellan was a Canadian REIT with Industrial (50% of NOI) and Office (50% of NOI) properties in the US (75% of NOI) and Canada (25% of NOI). Due to its diversified business model, the price of its units in the Canadian market did not fairly reflect the value of its assets, particularly the US industrial properties. Sale of the company provided the best outcome for shareholders.

Investment Considerations

Artis' Special Committee concluded that a sale would deliver the highest value to unitholders and I believe that a price around IFRS NAV ($15.35) would be reasonable. Potential softness in valuation of Retail and Office assets is likely to be balanced by a premium for the development potential of Industrial assets. As long as Artis remains a diversified public REIT fair value in an economic recovery is likely to be a 20% discount to NAV (80% of $15.35 = $12.28).

Firm Capital's efforts highlight the rights of preferred holders that might be triggered by potential corporate actions. Redemption at $25 par value would deliver significant gains to Series A/E holders, however, in the absence of a deal, they have downside price risk when coupons will probably reset lower in 2022/23.

Investors punished Artis in 2018 for reducing its dividend rate, but dividends simply transfer value rather than creating value. Any change in the dividend does not affect the underlying value of the company and its assets so this article does not offer any detailed commentary about past present or future dividends. The distribution (currently C$0.54/year) gradually returns a portion of the full NAV which we can now acquire in the market at a discount. The distribution is amply covered by AFFO and strong rent collection so it is very unlikely to be cut. Artis's 3Q20 earnings announcement promised a 3% distribution increase and Sandpiper promises that its nominees will support a 10% increase.

Disclosures & Notes

The author is a unitholder of Artis REIT. The author does not make any recommendation regarding any investment in any company mentioned in this article. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions.

Sandpiper females are larger than males, fight for territory, and can be polyandrous. It might be relevant.

Disclosure: I am/we are long ARESF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

2020-11-11 20:36:00Z

https://seekingalpha.com/article/4388157-artis-reit-break-up-will-deliver-value-who-will-wield-hammer

Bagikan Berita Ini

0 Response to "Artis REIT: Break-Up Will Deliver Value, But Who Will Wield The Hammer? - Seeking Alpha"

Post a Comment